Institutional Investors in Charleston: The Real Story (National Data + Tri-County Reality)

Are institutional investors really buying up all the homes in Charleston?

Not really. Nationally, “mom-and-pop” owners still make up the bulk of single-family rentals, and the largest institutional landlords have recently been net sellers—not net buyers. Locally, the data you shared shows “large investors” (100+ homes) represent a small slice of the single-family housing stock across the Charleston tri-county area.

Headlines blur the terms- define "institutional investor"

When people say “institutional investors,” they’re often lumping together very different buyer types:

iBuyers (OpenDoor-style models)

Small investors (individuals/LLCs with a handful of homes)

Mid-sized investors

Large institutional landlords (often defined as firms with 100+ homes or more, depending on the dataset)

That definition matters because the “Wall Street is buying everything” narrative typically implies large institutional landlords, not local investors buying one or two rentals. Freddie Mac research commonly uses tiers like small (1–9), mid-sized (10–99), and institutional (100+).

The national reality: small owners dominate single-family rentals.

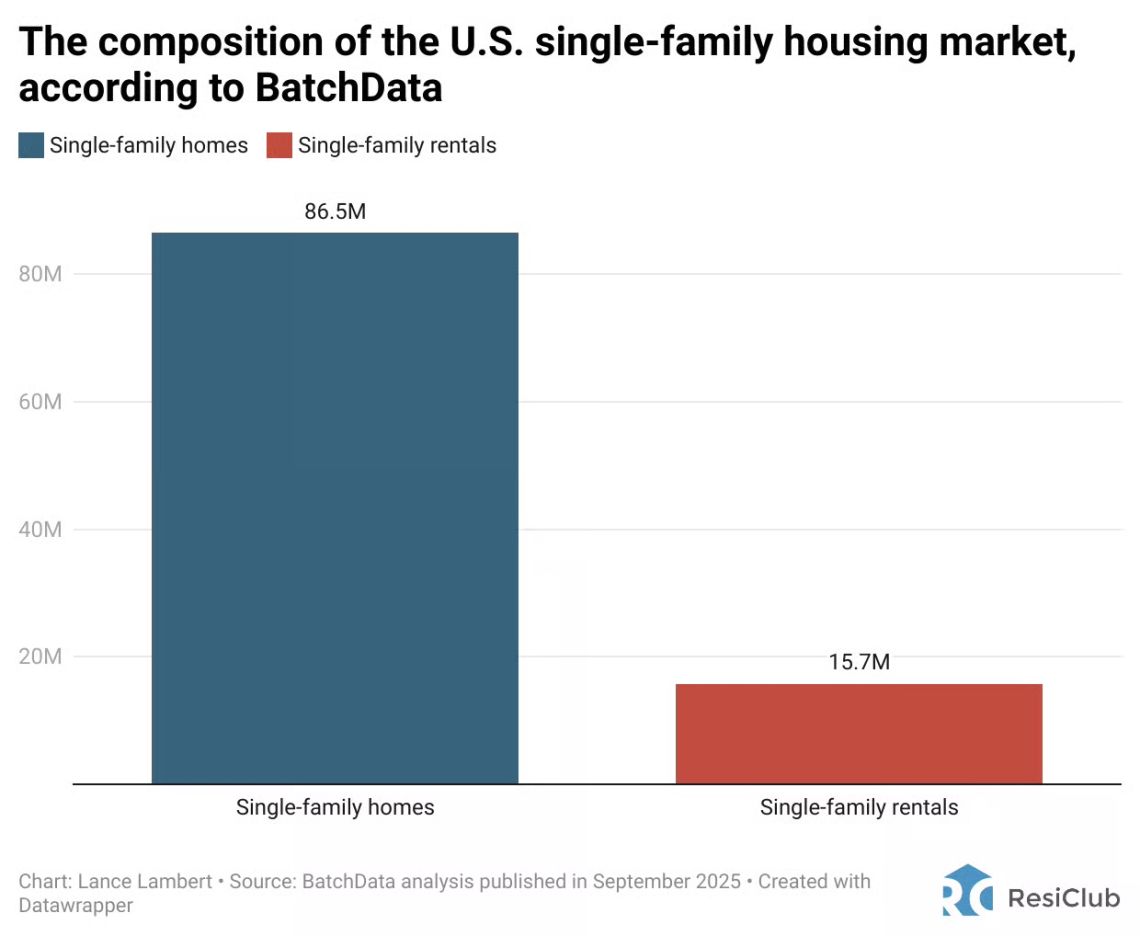

The U.S. has far more single-family homes than single-family rentals—and within rentals, ownership is still overwhelmingly small-scale.

BatchData’s analysis (via ResiClub) found 89.6% of single-family rentals are owned by landlords who hold 1–5 properties.

That same ResiClub post shows the broad market context: roughly 86.5M single-family homes vs 15.7M single-family rentals

Bottom line: if you’re trying to understand who “controls” single-family rentals nationally, the answer is still largely small owners, not institutions.

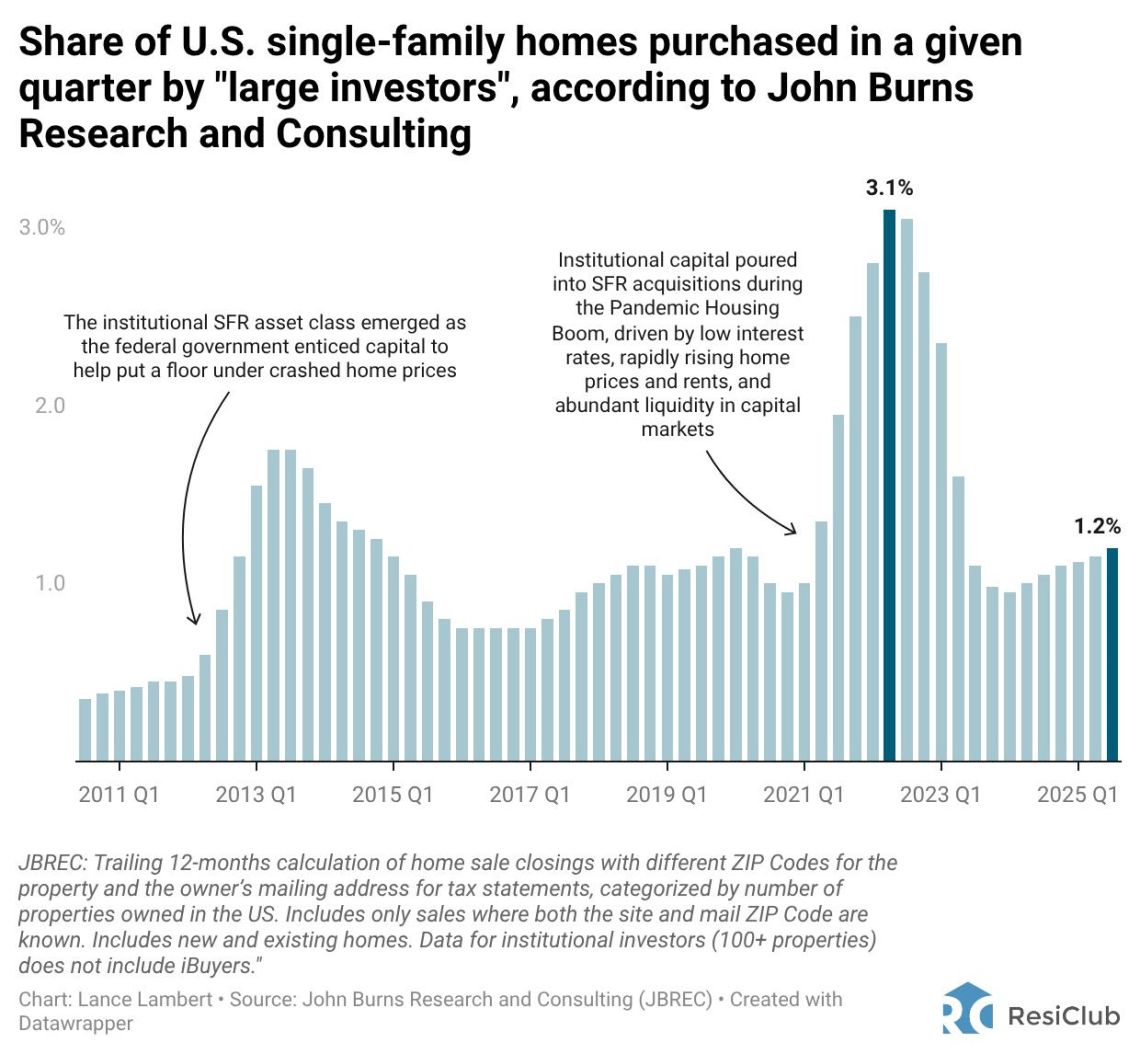

What's changed recently: Big institutional landlords have been net sellers

This is the part most people miss:

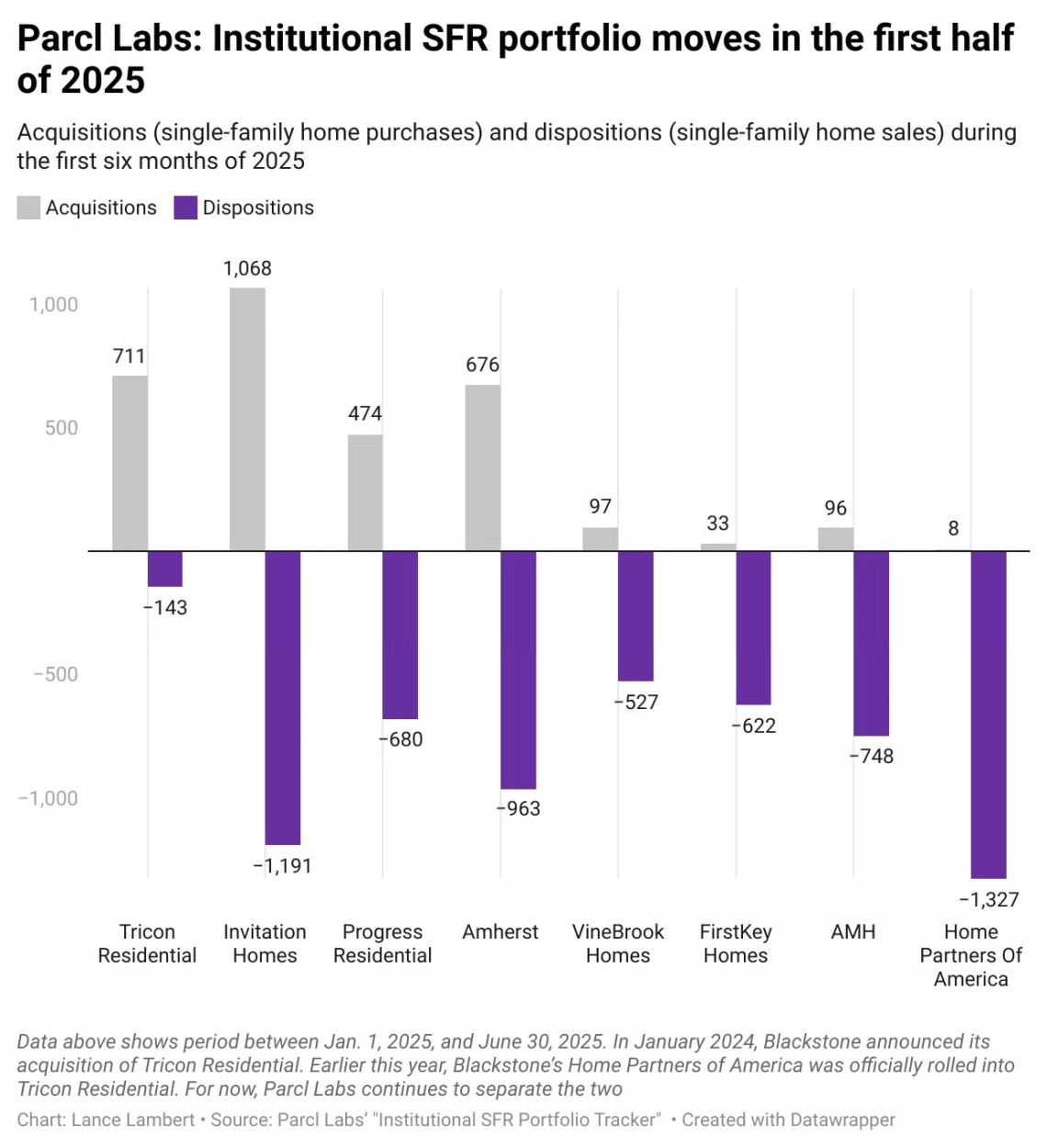

ResiClub reported that institutional landlords were net sellers of 3,038 single-family homes in the first half of 2025.

And Parcl Labs’ institutional SFR tracking shows several of the largest operators selling more than they bought in H1 2025.

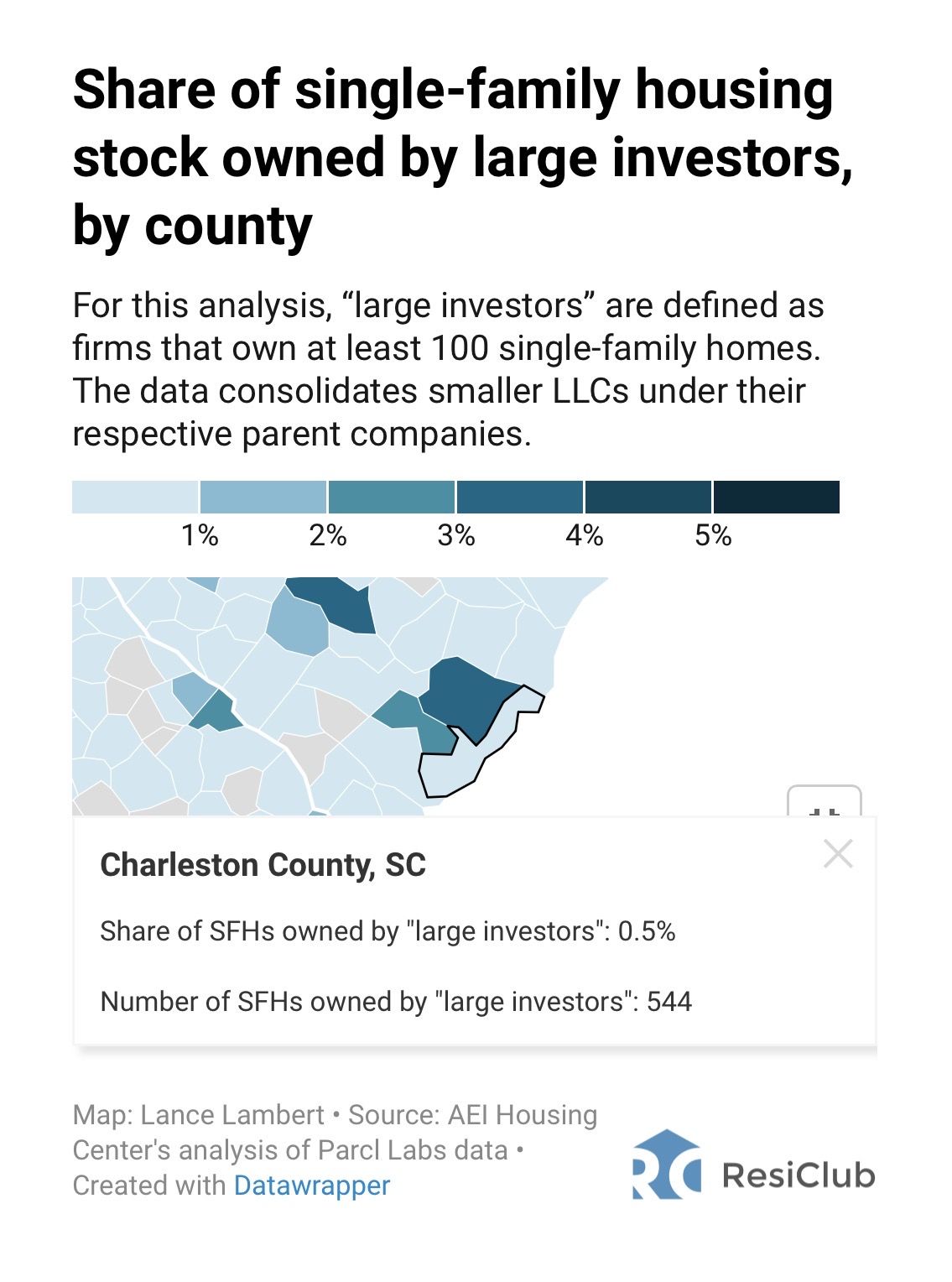

The Charleston Tri-County Reality: "Large investors" are a small share, and it varies by county

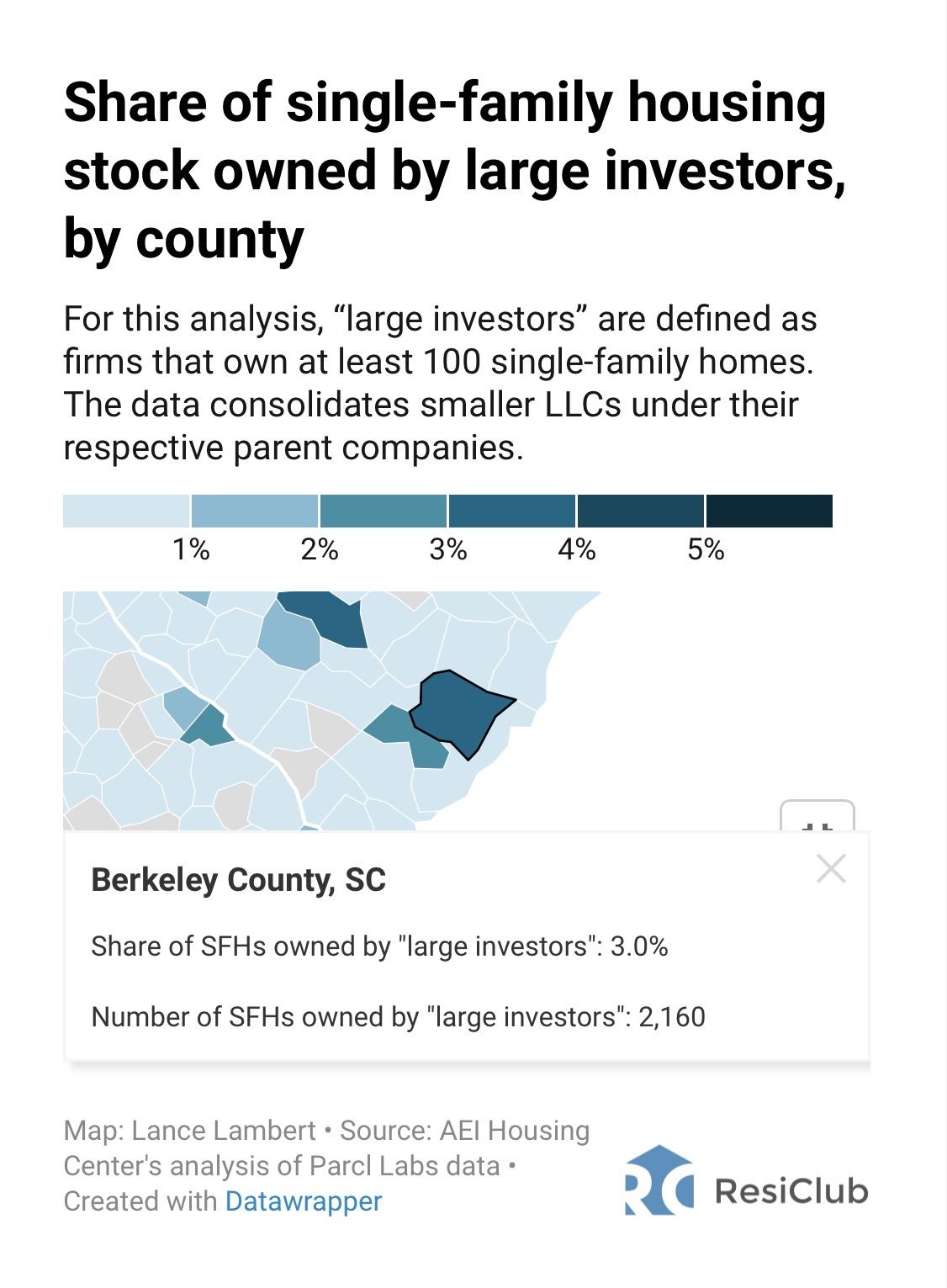

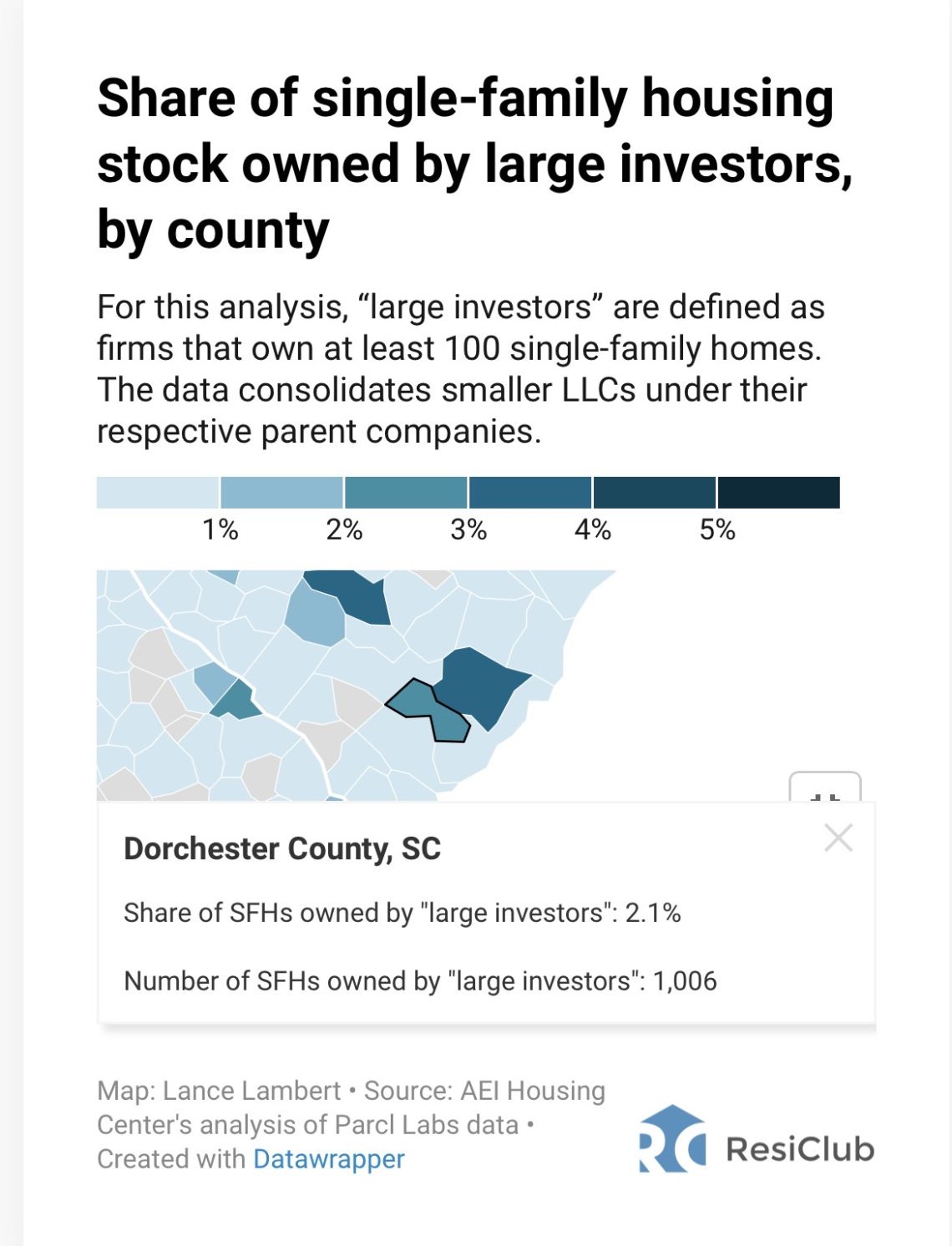

Based on the AEI Housing Center / Parcl Labs county-level map (where “large investors” are defined as firms with 100+ single-family homes), here’s what the local picture looks like:

Charleston County, SC: 0.5% of single-family homes owned by “large investors” (544 homes)

Berkeley County, SC: 3.0% (2,160 homes)

Dorchester County, SC: 2.1% (1,006 homes)

And zooming out a bit, AEI’s housing “playbook” summary for the Charleston MSA has also cited a low single-family institutional ownership share (the exact figure varies by methodology/timeframe), reinforcing the same general conclusion: institutions are not “owning Charleston.”

What this means for Mount Pleasant and Daniel Island buyers: if you’re shopping in high-demand areas within Charleston County, the bigger drivers of competition are usually local supply, lifestyle-driven demand, and financing affordability—not a wave of institutional takeovers.

If you want to talk through what this looks like in your exact price point and target area (Mount Pleasant vs Daniel Island vs Downtown vs Johns Island, etc.), click here to schedule a call, and I’ll break down the current on-market competition you’re actually up against.

"But I keep losing to investors" - what's probably happening instead

Even when institutions aren’t the main driver, it can feel like they are. A few common reasons:

You’re seeing more cash offers (many are not institutions—often local investors or buyers with equity).

Low inventory concentrates demand into fewer listings.

Rate-driven affordability shifts push more buyers into the same “sweet spot” price bands.

Some markets do have higher institutional presence—but that’s not evenly distributed across the U.S. (or across Charleston-area counties).

If you’re buying and you’re tired of guessing, schedule a call here—I’ll help you build a plan based on what’s happening right now in your niche (not what’s trending on national TikTok).

What buyers should do with this info:

If you’re buying in Charleston, Mount Pleasant, or the greater Charleston tri-county:

Don’t let “waiting out investors” delay your plan if the home fits your budget and timeline.

Focus on deal structure (timing, terms, certainty) and targeting (the right homes before competition stacks up).

Track the data that matters locally: new listings, days on market, price reductions, and contract activity.

Again—if you want a data-backed plan tailored to your neighborhood and budget, click here to schedule a call.

What sellers should do with this info:

If you’re selling, the takeaway isn’t “investors are gone.” It’s:

Your most reliable buyer pool is still typically primary-residence buyers (financed), plus some local investors in certain segments.

Pricing and presentation matter more when affordability is tight, and buyers are choosier.

If institutional landlords are net sellers nationally, that’s a reminder that big players adjust strategy, so your listing strategy should be hyper-local, not headline-driven.

If you’re thinking about selling in Charleston County, Mount Pleasant, or Daniel Island and want a clear plan for pricing and positioning, click here to schedule a call, I’ll walk you through what today’s buyer pool is actually doing.

What sellers should do with this info:

Institutional investors make for attention-grabbing headlines, but the data paints a calmer picture: small owners dominate single-family rentals nationally, major institutions have recently been net sellers, and in the Charleston tri-county, “large investors” appear to hold a relatively small share of the single-family housing stock (with differences by county).

If you want to understand what investor activity (and buyer competition) looks like in your exact Charleston-area neighborhood and price point, click here to schedule a call. I’ll help you build a smart next step whether you’re buying, selling, or both.

Seize the moment.

Now is the time to take advantage of the unique opportunities presented by the current market conditions.

If you're considering making real estate moves, reach out. We can't wait to guide you through the process.

.png)

_w.png)

.png)